Barrington Township First Appeal Deadline set for August 15

O'Connor discusses the first Barrington Township appeal deadline that is set for August 15.

CHICAGO, IL, UNITED STATES, August 14, 2025 /EINPresswire.com/ --Barrington Township is quickly becoming one of the wealthiest areas in the United States. As a prosperous suburb of Chicago, Barrington’s various towns and villages feature some of the most exclusive properties in Cook County and the demand to live in the township is at an all-time high. With high demand is great for those trying to sell their homes, it can be a hurdle for those that wish to stay, as the increasing value means higher property taxes. This is complicated further by Illinois already having some of the highest taxes in the nation.

The triennial reassessment by the Cook County Assessor’s Office (CCAO) is now hitting the township, meaning values are going through the roof. Residential property has seen an overall value increase of 33%, while commercial properties are up a staggering 47%. The only way to lower these values and the ensuing taxes is to utilize a property tax appeal. The initial deadline for appeals is set for August 15, 2025. After that time, taxpayers lose their chance to make appeals directly to the CCAO and must wait for Board of Review (BOR) appeals to open later in the year. O’Connor will break down the value surge caused by reassessment to see what is being hit the hardest.

Barrington Homes Jump 33% in Value

In 2024, the combined value of homes in Barrington Township was $4.08 billion. Thanks to reassessment, this was increased by 33% to $5.42 billion in 2025. It is hard to describe how severe that type of spike is, but homes increasing in taxable value by one-third overnight feel like an unthinkable statistic. This has become an all-too-common occurrence in Cook County, with reassessment dropping similar numbers of neighborhoods of all kinds. Due to the intrinsic value of Barrington Township homes already, this effect is magnified to bring some truly ludicrous numbers.

When we look at homes categorized by worth, we can see that most value in Barrington Township is concentrated in the most expensive homes. Homes worth between $1 million and $1.5 million were the largest block of homes when it came to value, totaling $1.52 billion after increasing by 37% from 2024. Homes worth over $1.5 million were in second place with $1.31 billion, which was an astounding jump of 43% from 2024. The triumvirate was rounded out by homes worth between $750,000 and $1 million, which jumped in value by 31%, reaching a total of $1.16 billion.

While modest homes contributed far less to the total value, they all suffered similar spikes. Residential property assessed between $500,000 and $750,000 was hit by an increase of 28%, while those set between $250,000 and $500,000 jumped up by 16%. While the smallest category of homes, those worth less than $250,000, experienced an uptick of 23%. As with most Cook County townships, the CCAO spared no one when it comes to value hikes.

2025 Reassessment Scours the North

It is not just Barrington Township that is getting beaten down by the CCAO in 2025, it is all of northern Cook County. Maine Township saw homes rise 25%, while Northfield added 30% to their taxable value. Norwood Park saw residential property increase by 19%, but some categories spiked as much as 58%. However, when it comes to homes, it appears that Barrington Township may be experiencing the highest value surges of all.

Commercial Properties Rise 47%

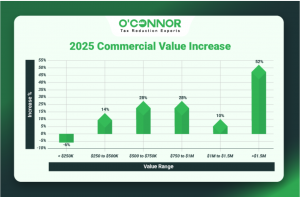

While residential property has been getting the hammer across Cook County all year long, businesses may be getting it even worse. After countless issues and complaints, the CCAO claimed they would begin putting more of the burden on commercial properties to help protect homeowners. While many question if this is even factual, statistics are starting to show that commercial property is getting smacked with higher values than ever before. This has been universal across all townships, even those that are not currently in reassessment. Barrington Township is certainly counted among the hardest hit, as business values spiked 47% in 2025, taking the total from $811.82 million to $1.19 billion.

At the head of the surge are commercial properties worth over $1.5 million. It is typical across the United States to see the majority of value centered on these types of enterprises. These elite properties experienced a massive jump of 52% in Barrington Township. According to CCAO, this category of property was valued at a combined $1.06 billion. That means that the top-tier businesses created 88.8% of all value in the township. Needless to say, these price surges had an outside influence on the overall increase.

Smaller commercial properties did not escape the hikes either, with the lone exception of those worth under $250,000, which actually saw a reduction of 6%. Those worth between $1 million and $1.5 million only saw an uptick of 10%, while the next tier experienced a substantial jump of 28%. Medium properties worth between $500,000 and $750,000 also gained 28%, while those assessed between $250,000 and $500,000 added 14%.

Appeals Become Necessary in Cook County

It was not long ago that property tax appeals were relatively unknown to homeowners. Businesses have routinely appealed values as cost-saving measures, but the average person was unaware that they could fight their taxes. This is no longer the case, as the aggressive and often incompetent policies of CCAO are pushing more people than ever before into questioning their values. Whether it is informal appeals to the CCAO or formal hearings before the BOR, taxpayers are fighting back in record numbers.

Appeals are the only option to restore some sanity for the Chicago area. Attempts to fix the problem legislatively have all failed, while taxing bodies demand more and more funding. Now, even the CCAO themselves are encouraging people to appeal the very values they issued, as they are no longer reliable. A series of computer problems has delayed bills across the county and called into question everything that has been sent out by the CCAO. It is both a necessity and the perfect opportunity to protest taxes, so all taxpayers should be prepared.

Assessor Appeal Deadline is August 15, 2025

Thankfully for the people of Barrington Township, appeal deadlines in Cook County come in waves. The first is scheduled for August 15, 2025. This is the final date that informal appeals can be lodged with the CCAO in an effort to lower taxable value. After that, residents will have to wait until a few months later when they can start appealing to the BOR. While the BOR is more popular than ever, much can be achieved with informal appeals. If these appeals are rejected, then BOR is still an option.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.